Nigeria’s Remittance Inflows Reach USD 23 Billion in 2025, Marking the Highest Level in Five Years

Nigeria’s remittance market surges as inflows hit USD 23B in 2025, driven by strong diaspora support, rising digital adoption, and improved financial stability.

Record remittance inflows and rising digital adoption underscore Nigeria’s structural transformation, signaling improved transparency, policy clarity, and a more resilient financial ecosystem.”

MUMBAI, MAHARASHTRA, INDIA, December 10, 2025 /EINPresswire.com/ -- Nigeria’s remittance sector is undergoing a major structural shift, marked by record inflows and rapid digital adoption. In 2025, remittance inflows reached USD 23 billion, the highest level recorded in the past five years, highlighting the sustained resilience of Nigeria’s global diaspora despite global inflation and macroeconomic pressures. This surge has played a pivotal role in supporting Nigeria’s broader economic framework and strengthening external liquidity.— Omkar Manjrekar

Nigeria’s Foreign Reserves Strengthen as Remittances Surge -

Recent data reveals a period of robust growth for Nigeria's remittance market, directly bolstering the nation's economic stability and external liquidity.

• Five-Year High in Remittances: According to Makreo Research, Nigeria’s remittance inflows reached USD 23 billion in 2025. This figure represents the highest level in the past five years and demonstrates the sustained strength of diaspora contributions despite global inflation and fluctuating economic conditions.

• Surge in Formal Channels: The Central Bank of Nigeria (CBN) reported that monthly formal remittance inflows increased from approximately $200 million to $600 million in recent months, driven by improved policy clarity and greater trust in regulated transfer channels.

• Strengthened Foreign Reserves: Nigeria's foreign reserves reached USD 46.7 billion in December 2025, the highest level in almost seven years. This rebound was driven by a combination of factors:

▸An oversubscribed USD 2.4 billion Eurobond issuance.

▸Improved crude oil export receipts.

▸Resilient diaspora remittances, which increased from USD 4.93 billion in Q1 2025 to USD 5.3 billion in Q2 2025.

• Enhanced Economic Stability: With foreign reserves sufficient to cover more than 10 months of imports, Nigeria's capacity to manage currency volatility and balance-of-payment pressures has been significantly reinforced.

• Growing Share of GDP: The economic importance of remittances is growing rapidly, with personal remittances received jumping from 5.4% of GDP in 2023 to 11.3% in 2024.

Traditional Remittance Networks Hold as Digital Adoption Rises -

Nigeria’s remittance market combines traditional operators with fast-growing digital platforms, each serving distinct consumer segments.

The Enduring Role of Traditional Operators:

Traditional MTOs remain vital due to their widespread agent networks and strong consumer familiarity, particularly in semi-urban and rural areas with limited banking access.

• Western Union: Maintains a dominant market position but includes a 2–4% exchange rate markup and transaction fees of up to $25 for credit card payments.

• MoneyGram and Ria: Remain popular choices for cash pickup services, serving populations where access to digital banking is limited.

The Rise of Digital Platforms and Fintech:

Digital remittance platforms and local fintechs are gaining strong traction, especially among tech-savvy Nigerians and the diaspora.

• Digital MTOs: Platforms like Remitly offers express transfers from $3.99 and free economy transfers, while Wise attracts cost-conscious users with transparent mid-market exchange rates and efficient bank-to-bank transfers.

• Nigerian Fintech Expansion: Local fintechs are expanding into cross-border payments through strategic partnerships, offering competitive FX rates, mobile-first experiences, and value-added services such as bill payments.

• Projected Digital Growth: The expansion of digital channels are projected to grow at a 15.92% annual rate, accelerating the shift toward real-time, digitally enabled remittance infrastructure.

Digital Transformation Accelerates Among Nigerian Youth -

Nigeria’s youthful demographics are accelerating the shift toward digital finance and reshaping the remittance landscape.

• Population: Estimated at 228 million with a median age of just 17.2 years.

• Digital Trust: This young population, combined with CBN-led cash reduction initiatives have increased digital trust and driven greater use of mobile and account-based transfers

• Impact on SMEs: The shift is critical for 40 million micro and small enterprises (over 80% of businesses), improving operational efficiency and access to finance.

Diaspora and Remittance Corridors Supporting Nigeria’s Inflows -

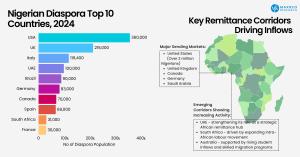

Inflows are concentrated in established diaspora corridors, though new regions are gaining importance.

Major Sending Markets:

• United States - home to one of the largest Nigerian diaspora communities, with more than two million residents

• United Kingdom

• Canada

• Germany

• Saudi Arabia

Emerging Corridors Showing Increasing Activity:

• United Arab Emirates (Dubai) - strengthening its role as a strategic African remittance hub

• South Africa - driven by expanding intra-African labour movement

• Australia - supported by rising student inflows and skilled migration programs

eNaira Visibility Rises, but Market Uptake Remains Limited

Nigeria’s Central Bank Digital Currency, the eNaira, continues to receive regulatory support as the CBN positions it as a strategic tool to streamline cross-border transactions and improve financial system efficiency.

Intended benefits include:

Faster settlement for cross-border and domestic transfers

Reduced transaction and processing costs

Greater transparency and traceability across remittance flows

Adoption constraints remain, driven by:

Limited digital literacy and user awareness

Low usage among Nigerians in the diaspora

Interoperability gaps with established global remittance platforms

Market Structure and Shifting Consumer Preferences -

In 2024, Nigeria’s remittance landscape continued to evolve, supported by demographic shifts, increasing financial digitalization, and the growing role of fintech platforms.

Key structural highlights include:

• Inward transfers accounting for 54.23% of total remittances

• Personal transfers representing 88.72% of all inflows

• Rapid digital expansion with digital channels expected to grow at 15.92% annually

• Ghana's standout performance in the region, with 91% growth in remittance inflows

Emerging Opportunities and Strategic Outlook -

The intersection of diaspora strength and digital disruption creates significant opportunities for future growth.

Key Opportunities:

• Developing diaspora engagement programs.

• Enhancing the scalability of fintech solutions.

• Leveraging blockchain-driven settlement networks.

• Strategic diversification of remittance corridors.

However, the market is rapidly evolving. According to Makreo Research, a Mumbai-based global consulting and market intelligence firm, the Nigeria Remittance Market is entering a new phase of growth, driven by rising digital adoption, clearer policies, and a more transparent financial infrastructure. As Nigeria advances its financial modernization agenda, the remittance sector stands at a strategic intersection where diaspora strength meets digital innovation, positioning it not merely as a source of income, but as a catalyst for economic resilience, financial inclusion, and long-term national development.

Related Reports:

Africa Fintech Market Size and Forecast (2021–2030)

For tailored insights or specific inquiries, explore our comprehensive Banking, Financial Services, and Insurance Reports

Saurabh Adsule

Makreo Research and Consulting

+91 96196 99069

email us here

Visit us on social media:

LinkedIn

X

Other

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.